Enhance your small business tax record-keeping with these simple tips. Along with K-1s, maintain information of your contributions and distributions, plus copies of the entity’s return. Without them, your private return lacks the documentation it wants. When I work with shoppers, one of the first issues I ask about is their records. Not because I love paperwork (I don’t), however as a end result of what receipts to keep for taxes 1099 good record-keeping is the backbone of a robust tax place.

- If a friend or family member provides your childcare, keeping your records of these payments is a good suggestion.

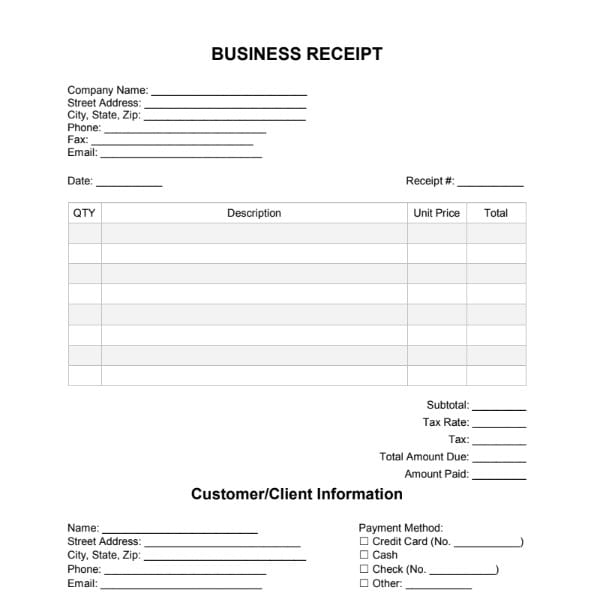

- This data might help guide your receipt administration practices.

- Well, a number of corporations have merchandise that may assist you to manage receipts with only a few clicks of your mouse—or camera phone.

- From setup fees to payroll taxes, S companies are an enormous accountability.

If you have a retirement account, compile records of contributions to your IRAs or 401(k)s. Go To the IRS site to see eligibility requirements for claiming deductions for conventional IRAs, which may be available relying on your income level. Beginning with the 2018 tax yr, unreimbursed worker bills are no longer deductible for federal taxes.

Payroll

And when you employ staff, employment tax information are non-negotiable. I advise preserving all documents tied to your return for no less than three years. Lastly, you should observe that being married and filing a joint return could also have an result on how a lot you should save for 1099 taxes.

Earnings Tax

Again, when you’re a full-time W-2 worker, the corporate that employs you pays a portion of your medical well being insurance plan. But that costs them cash, so your employer gets to write off that expense. You Will wish to hold certain information, including Form 8606, which tracks nondeductible contributions made to your IRAs and helps avoid being taxed again when you withdraw the funds.

Keeper’s accounting software is nice at choosing out enterprise https://www.kelleysbookkeeping.com/ expenses, even if you put them on a card that you just additionally use for personal purchases. There are a couple of other receipts that you can be wish to save, relying on your personal tax situation. For some, it is helpful to deduct your state and native gross sales tax in your itemized deductions, quite than the quantity of state and native earnings taxes you paid during the 12 months.

How To Handle And Keep Business Tax Receipts

If you pay for something in money, you’ll be able to all the time snap a pic of the paper receipt together with your telephone. Tax season runs smoother when you know exactly what information to keep—and for how lengthy. Use the checklist under to track the documents that show your earnings, deductions, and credit, whether you’re an worker, freelancer, or small enterprise owner. Keep In Mind that financial institution and/or credit statements shall be enough proof if you get audited, but they aren’t an alternative to claiming tax deductions if you file your returns. If you’re maintaining receipts to claim sure self-employment tax deductions, make certain it has a report displaying what you got, how much it value, the date of buy and the aim.

Residential Clean Power Credit Score

To be on the safe side, you must typically keep your 1099s, receipts, and other data of business expenses for at least six years. These are sent out to freelancers, independent contractors, and business house owners who receives a commission by way of third-party cost processors, like credit cards and PayPal. You must also hold financial institution statements for at least seven years, as this might help you track earnings and deductions, and provide evidence of income and expenses. You should maintain your tax returns and supporting documentation for no much less than 4 years, as per California’s statute of limitations.